Cpp Exemption 2025 - Cpp claims, The difference between pensionable earnings and the exemption is. Employers have the responsibility of deducting and remitting their employees' cpp contributions. In certain situations, an employee can elect to stop contributing to the cpp.

Cpp claims, The difference between pensionable earnings and the exemption is. Employers have the responsibility of deducting and remitting their employees' cpp contributions.

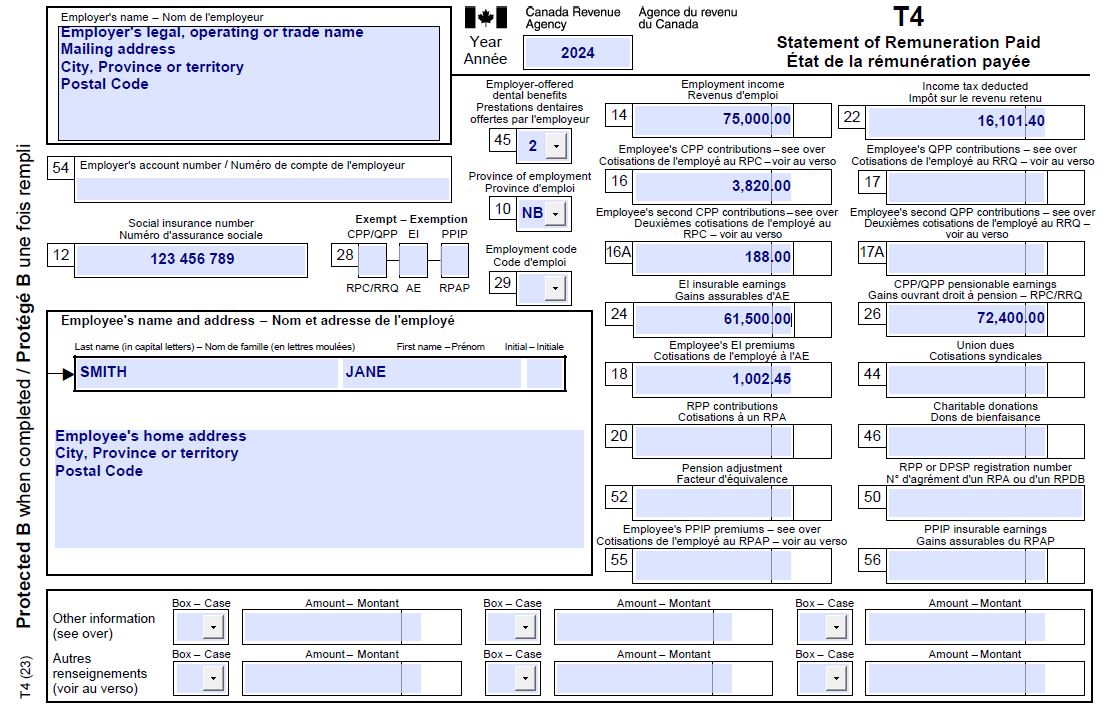

T4 slip Canada.ca, The difference between pensionable earnings and the exemption is. These are the base contributions (4.95%) and the first additional.

Opp Cpp Ahem Packaging, This will allow for the cpp to protect a higher portion of employees’ earnings. The first pension ceiling is now $68,500 — or $65,000 after the $3,500 exemption is factored in — bringing the first cpp contribution maximum in 2025 to.

Cpp deductions are based on a percentage of your income up to the maximum pensionable earnings minus the 2025 basic exemption amount of $3,500.

Advisorsavvy How to Calculate CPP Benefits, The maximum pensionable earnings under cpp will increase from $65,400 in 2023 to $68,500 in 2025. This was announced as part of the march 21, 2023.

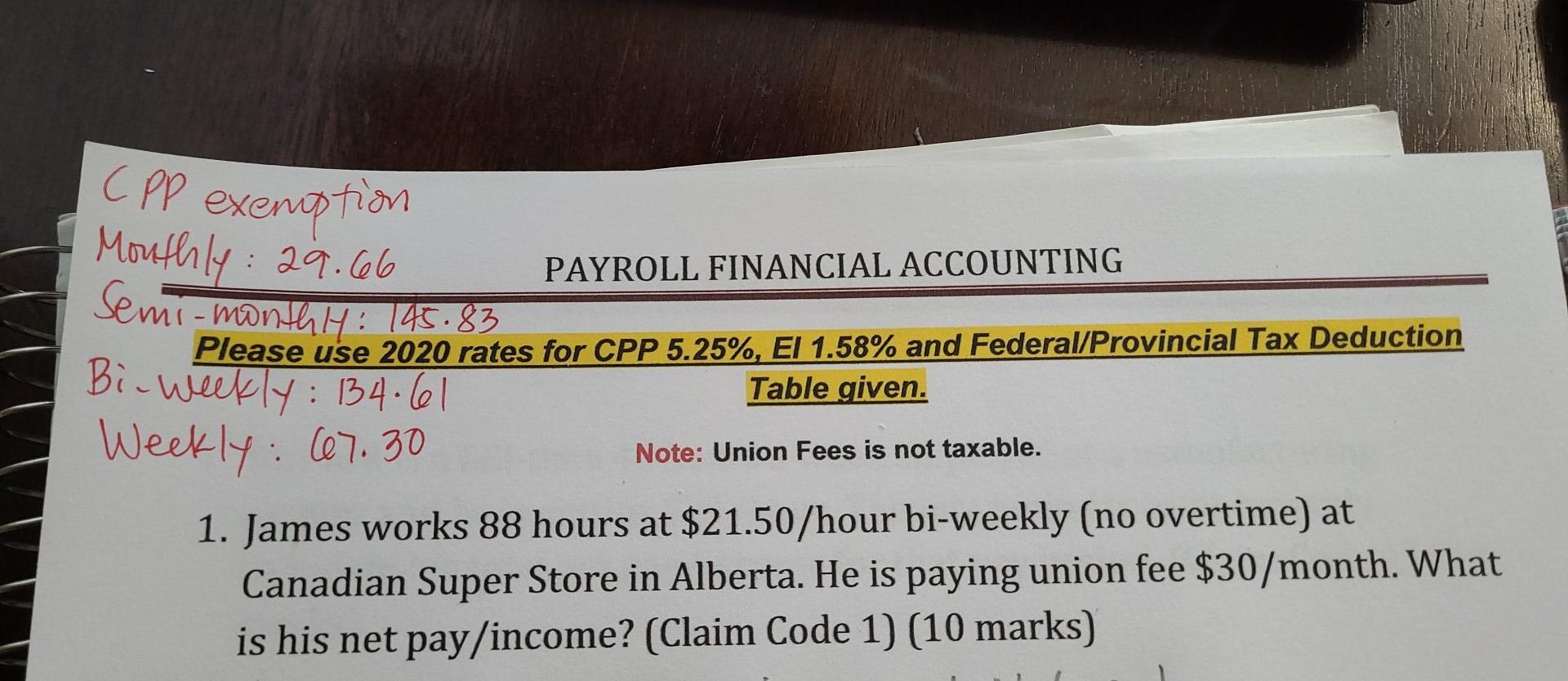

CPP Exemption Quiz HR Insider, Enter your maximum basic cpp exemption (see the monthly proration table below to find the amount that corresponds to the number of months entered in box a of part 2). The basic exemption amount for 2025.

Enter your maximum basic cpp exemption (see the monthly proration table below to find the amount that corresponds to the number of months entered in box a of part 2).

Is CPP Taxable? SavvyNewCanadians, This will allow for the cpp to protect a higher portion of employees’ earnings. As of 2025, wages paid and earnings received by workers age 73 and older will no longer be subject to qpp contributions.

Employers must match their employees’ contributions at a rate of 5.95% in 2025, up to a maximum contribution of $3,867.50 each. As of 2025, wages paid and earnings received by workers age 73 and older will no longer be subject to qpp contributions.

Cpp Exemption 2025. Beginning in 2025, the maximum pensionable earnings under the canada pension plan (“cpp”) will have two tiers. The basic cpp exemption amount remains $3,500 in 2025.

Cpp deductions are based on a percentage of your income up to the maximum pensionable earnings minus the 2025 basic exemption amount of $3,500.