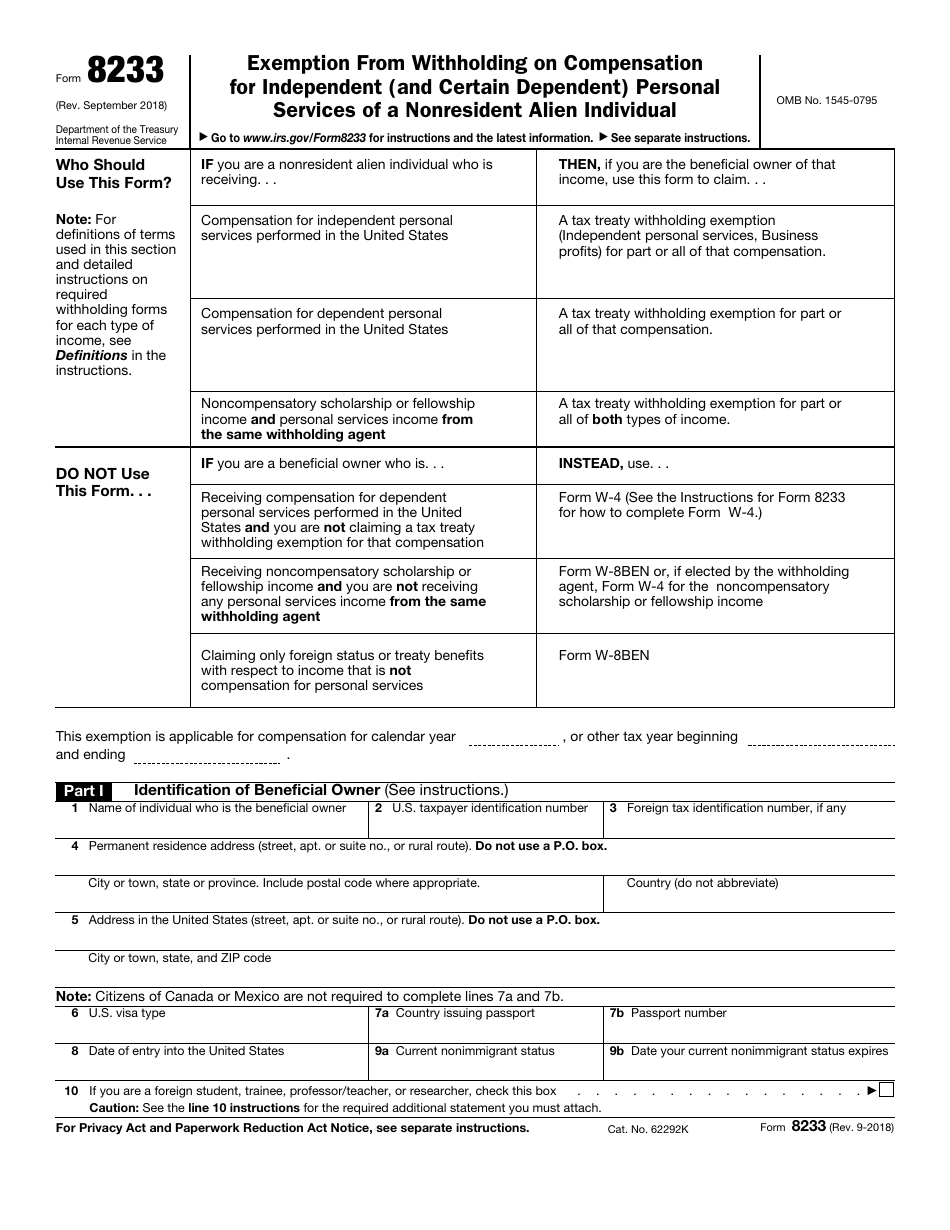

Nonresident Alien Estate Tax Exemption 2025 - Nonresident Alien Estate Tax Exemption 2025. Conversely, for nrncs, the exemption is only $60,000 and the estate tax becomes subject to a 40% estate tax — which means there can be a significant amount of estate tax for. Between the estates of citizens and resident aliens, on the one hand, and. IRS Form 8233 Download Fillable PDF or Fill Online Exemption From, A higher exemption means more estates may be exempt from the federal tax this. The standard lifetime tax exemption, which allows u.s.

Nonresident Alien Estate Tax Exemption 2025. Conversely, for nrncs, the exemption is only $60,000 and the estate tax becomes subject to a 40% estate tax — which means there can be a significant amount of estate tax for. Between the estates of citizens and resident aliens, on the one hand, and.

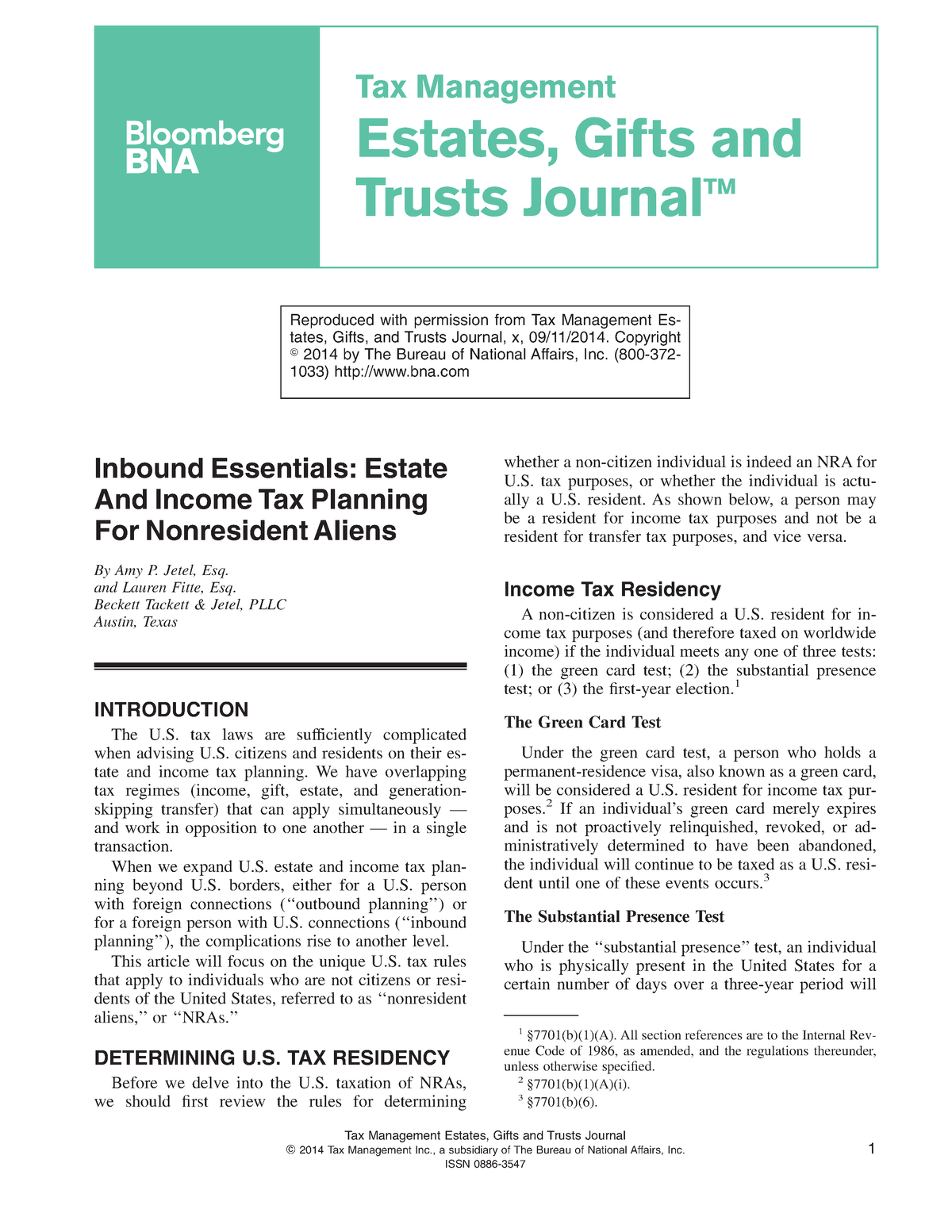

Estate and Tax Planning for Nonresident Aliens ( PDFDrive, Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per. Because the lifetime gift and estate tax exemption applicable to a u.s.

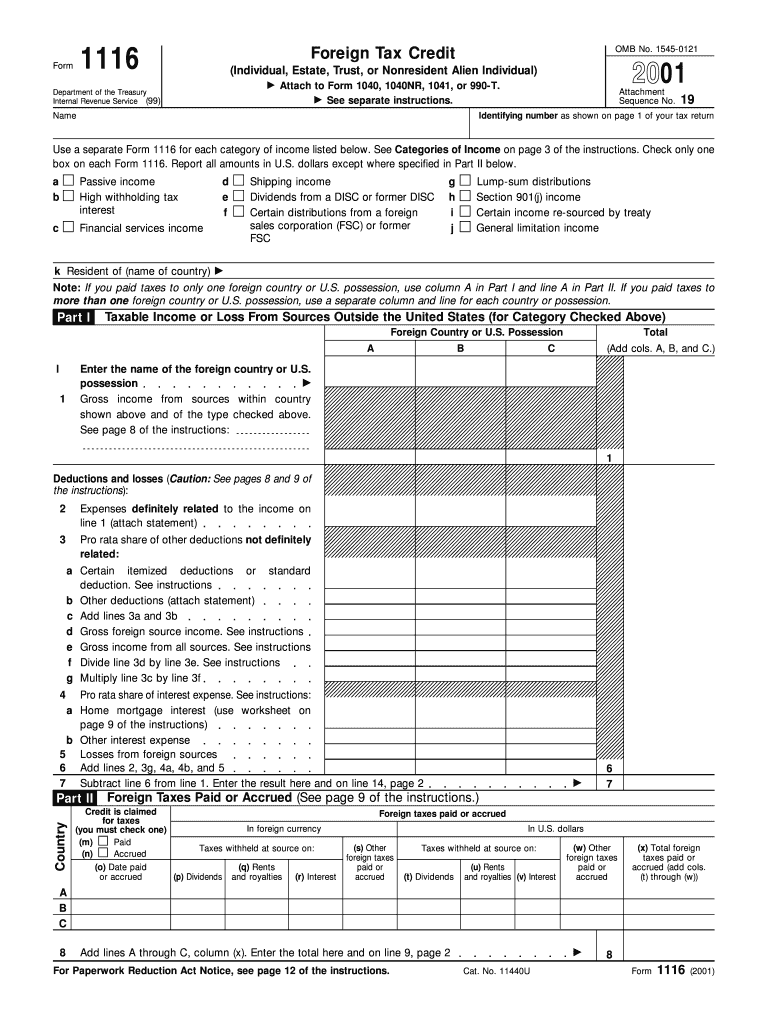

Form 1040NR U.S. Nonresident Alien Tax Return Definition, Conversely, for nrncs, the exemption is only $60,000 and the estate tax becomes subject to a 40% estate tax — which means there can be a significant amount of estate tax for. Citizen who is not domiciled in the united states (a non.u.s.

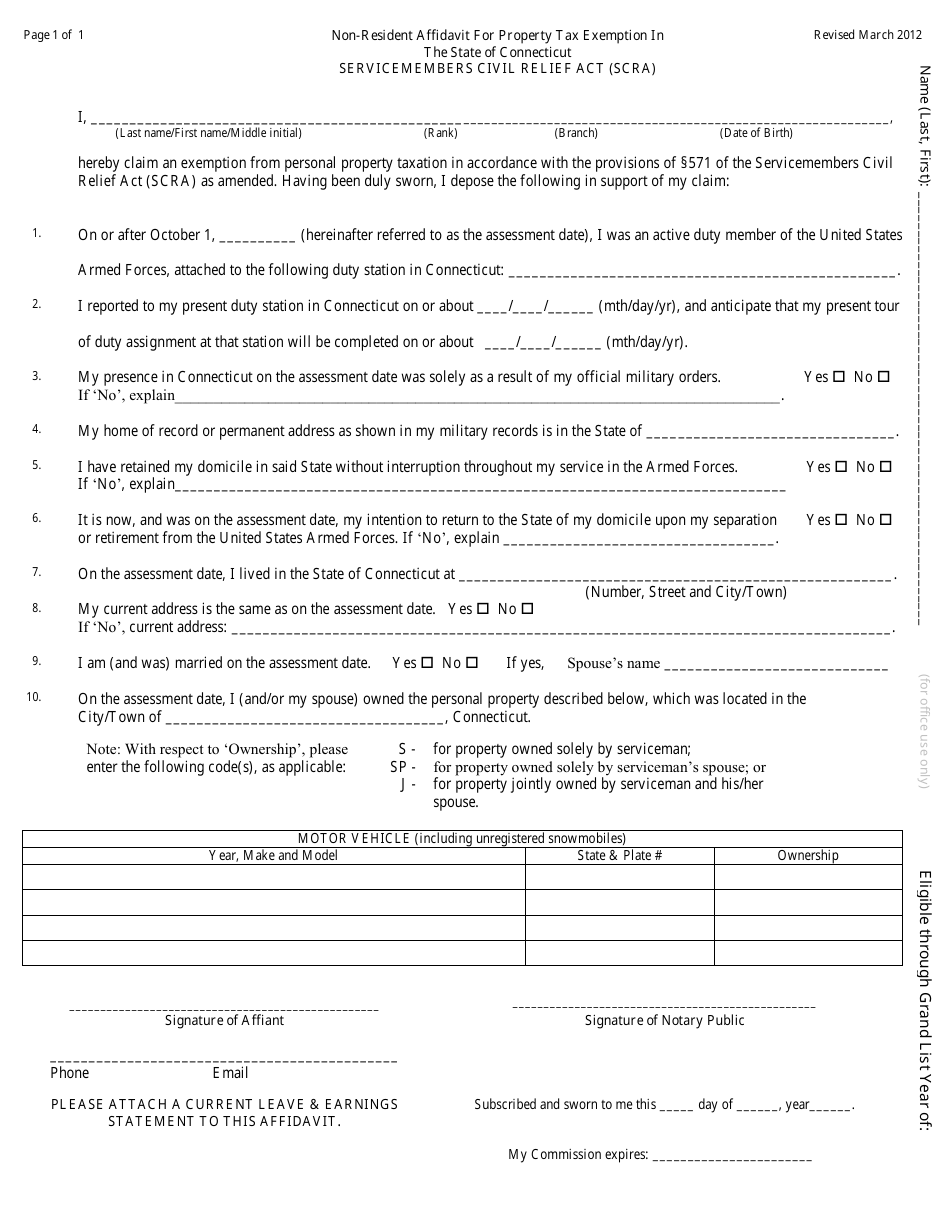

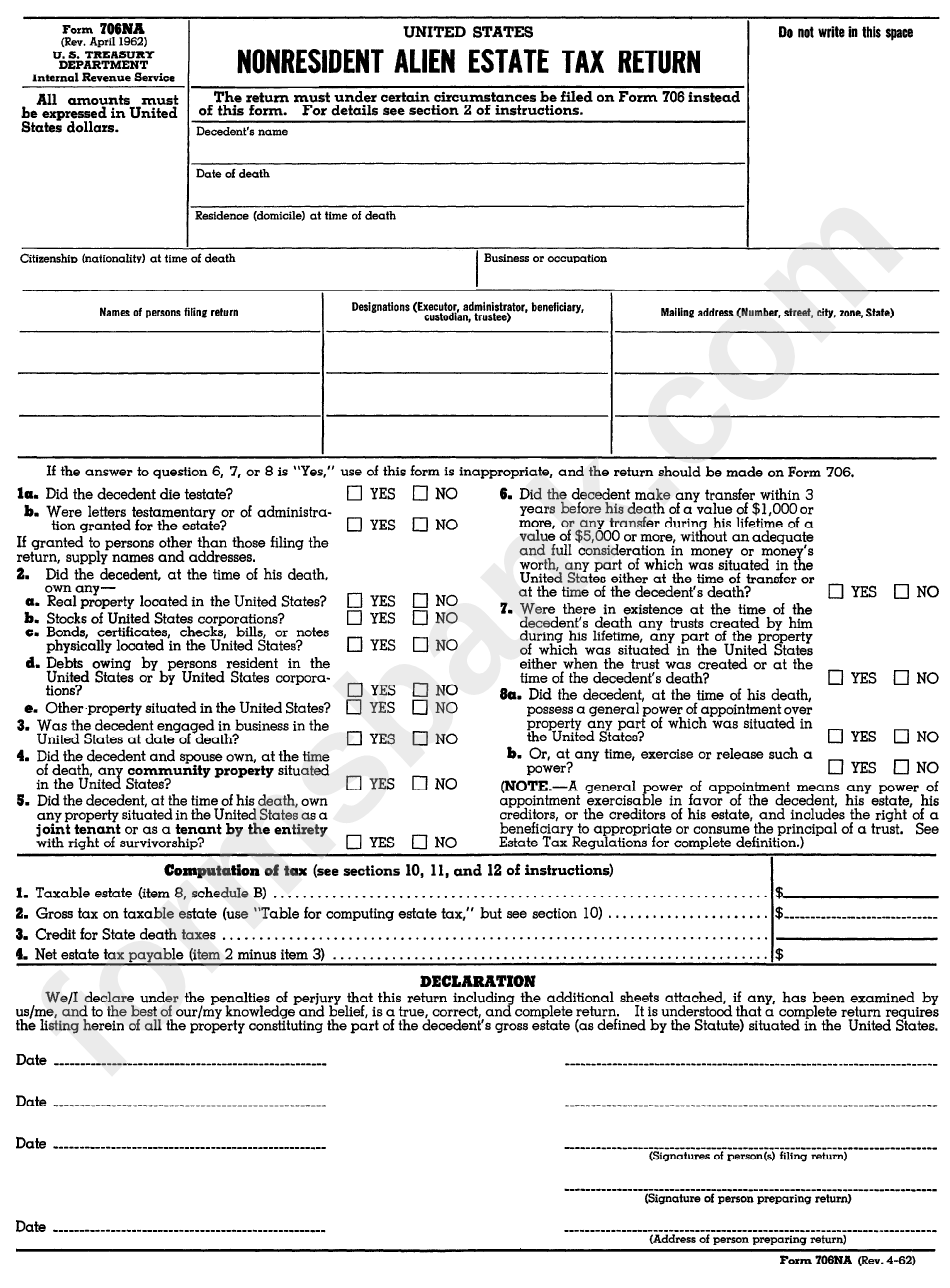

Form 706na (0462) Nonresident Alien State Tax Return printable pdf, The tax applies whether or not. Nonresident tax return for 2023 tax year is 15 april, 2025.

Es Seguro Viajar A Nicaragua 2025. Nicaragua es un país relativamente seguro para viajar, aunque […]

Instead of the $13,610,000 (exemption amount for 2025 that is indexed to inflation), to which united states citizens and permanent residents (greencard holders).

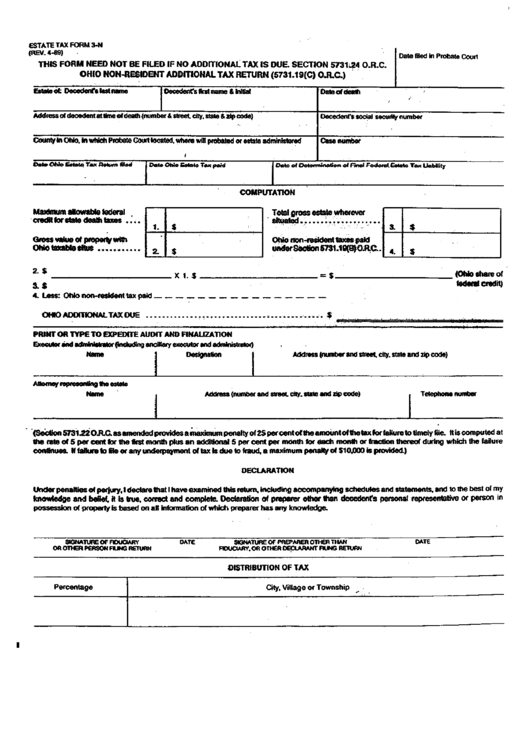

Form 3N Estate Tax Form NonResident Additional Tax Return printable, Conversely, for nrncs, the exemption is only $60,000 and the estate tax becomes subject to a 40% estate tax — which means there can be a significant amount of estate tax for. 22, 2025, the irs reminded taxpayers that they need to answer a digital asset question and report any related income when filing their 2023 federal.

Historical Estate Tax Exemption Amounts And Tax Rates, Last updated 24 april 2025. Between the estates of citizens and resident aliens, on the one hand, and.

Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, A nonresident alien domiciliary is entitled to an estate tax credit of $13,000 (which excludes the first $60,000 of the taxable estate) instead of the $5 million exclusion available to a. The deadline to file your u.s.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at10.43.53AM-9e425788de3d4ad493784be2f13f752d.png)

Form 706 Na (Rev. 011965) Nonresident Alien Estate Tax Return, The deadline to file your u.s. Instead of the $13,610,000 (exemption amount for 2025 that is indexed to inflation), to which united states citizens and permanent residents (greencard holders).

Between the estates of citizens and resident aliens, on the one hand, and.